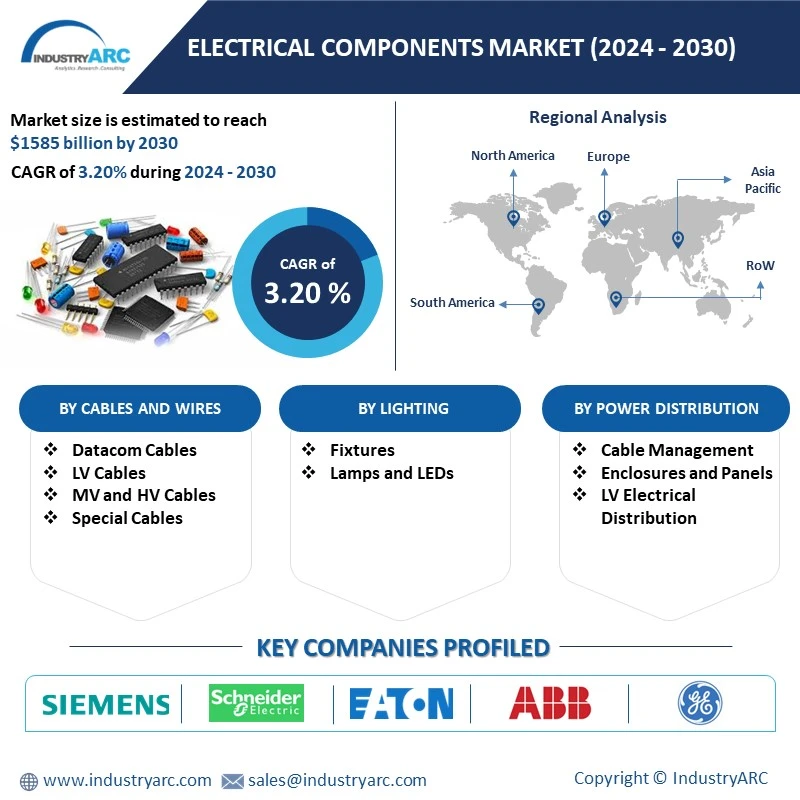

Electrical Components Market Overview

The

Electrical Components market size is forecast to reach

USD 1.6 trillion by 2031, after

growing at a CAGR of 3.2% during the

forecast period 2024-2031. Electrical components of diversified ranges are imperative to several industries as they are responsible for controlling currents or voltages, and several other long-running advantages. The growth of the Electrical Components Industry is influenced by a number of prominent factors, such as rising penetration of industrial IoT for

digital twins, advancements in semiconductor technology and popularity of the Stretchable Electronic applications. Electrical components are an indispensable part of every business sector, including industrial manufacturing, automotive, healthcare, aviation and many more. In addition, the avant-garde opportunities offered by the next generation electronic devices, such as smartphones, laptops, wearable electronics and bioelectrical devices continue to promote the growth of the market. Therefore, the surge of new age of technologies, pertinent to autonomous vehicles, bioelectrical devices, AI-powered computer assistants, and other array of innovations propelled the growth of the Electrical Components Market.

Report Coverage:

The report “Electrical Components Market – Forecast (2024-2031)”, by IndustryARC, covers an in-depth analysis of the following segments of the Electrical Components market.

By Building Automation: Building Automation, Datacom Accessories, Security & Wiring Accessories

By Cables & Wires: Datacom Cables, LV Cables, MV&HV Cables and Special Cables.

By Energy Distribution: MV&HV Energy Distribution

By Industrial Automation: Automation Controls, Auxiliary Controls, Drives & Motion Controls, Measurement Controls and Relays.

By Lighting: Fixtures, Lamps & LEDs

By Power Distribution: Cable Management, Enclosures & Panels, and LV Electrical Distribution

By Renewable Energies: HVAC and Renewable energy.

By Safety & Tools: Safety Equipment, Working Tools & Accessories and Others

By Geography: Americas, South America, Europe, APAC, and RoW.

Market Snapshot:

Key Takeaways

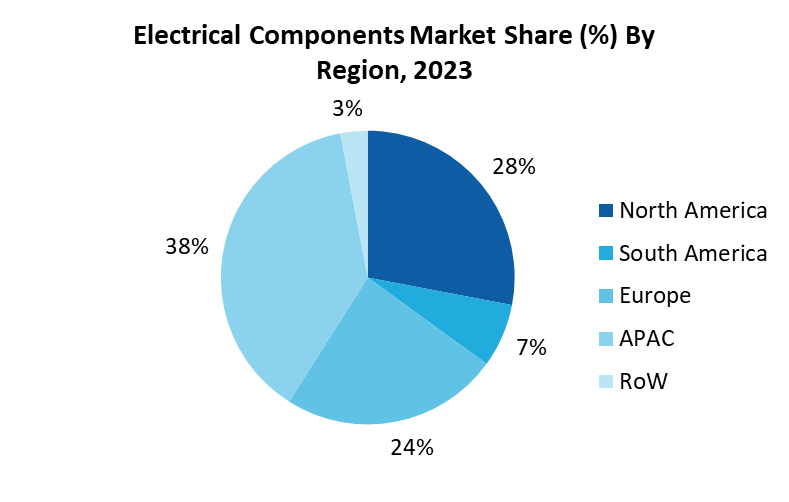

• Asia Pacific region is analyzed to be the major region for the Electrical Components Market, owing to the promising penetration of smartphones, prominence of electronics manufacturing sectors and expansion of the IT and telecom sectors.

• Heating, ventilation, and air conditioning (HVAC) technology is expected to emerge with high growing owing to the growing adoption of smart homes and related technologies.

• The strong penetration of smartphone and other kinds of smart devices along with the prevalent demand of bandwidth connectivity are some of the factors that resulting to the positive impact on the market growth.

By Product - Segment Analysis

By building automation, the Electrical Components Market is segmented into Building Automation, datacom accessories, security and Wiring accessories. Among them, security segment is analyzed to hold the maximum share of 40% in 2023. The dominance of the segment is witnessed owing to government initiatives to promote the smart sensors owing to the rising concern of safety along with the growing adoption of smart home technologies. For Instance: According to World Bank Reports, Indonesia has shown significant growth in the investments done in industrialization and construction sector owing to different smart city projects and building automation programs.

By Lighting - Segment Analysis

By lighting, the Electrical Components Market is segmented into Fixtures and lamps & LEDs. Out of which lamps & LEDs is analyzed to hold the maximum share of 57% in 2023. The growth of segment is attributed owing to the escalating adoption of LED lighting in both the urban and semi-urban provinces of the country. For Instance: In the present scenario, India is rapidly evolving from utilizing conventional products to LEDs. The LED lighting is being precisely adopted in residential, commercial and industrial sectors across the country. According to Electric Lamp and Component Manufacturers Association of India (ELCOMA) has estimated that India LED sector is estimated to reach around $681.14 billion by the end of the year 2031 Moreover, the Initiatives taken by the central government is positively influencing the surge and adoption of emergency lighting in India.

By Geography - Segment Analysis

Asia Pacific region is analyzed to be the major region with a growth rate of 3.6% for the Electrical Components Market, owing to the promising penetration of smartphones, prominence of electronics manufacturing sectors, expansion of the IT and telecom sectors and government support for initiating IoT and LTE integration. By 2025, the GSMA predicts that 5G networks will reach 1.2 billion connections or one-third of the world's population. The rising integration of 5G network services across the globe is observed to boost the demand for electronic components. The market growth is being driven by several factors such as increasing demand for consumer electronics, the rollout of 5G networks and the growth of high-speed data communication, advancements in IoT, and increasing industrial automation. In January 2023, Renesas unveiled a new intelligent power device (IPD) for automobiles that manage power distribution in cars flexibly and safely to satisfy the demands of the next E/E (electrical/electronic) designs. Thus, this is expected to drive market growth during the forecast period.

Drivers – Electrical Components Market

• Rise of Renewable Energy Solution

Asia Pacific was the dominating renewable energy market with a market share of over 35% in 2023. It is estimated that over half of the renewable energy across the globe is consumed in Asia Pacific region. The rapid industrialization and urbanization in the region had resulted in the rapid increase in the pollution levels. Furthermore, a rapid increase in the population and rise in the residential projects in the region is fuelling the demand for the electricity.

• Large-scale adoption of Industrial Automation Solution

The Industrial Automation solution has been witnessing rapid advancement in recent years, which eventually highlighted the emergence of latest wireless devices and other industrial communication solutions, thereby driving the growth of the Electrical Components Market. The global supplier of IoT intelligent systems, Industry 4.0, and machine automation solution, Advantech expanded its line of device servers and Modbus gateways with the launch of the EKI-1521I-SC-A, EKI-1221I-MT-A, and EKI-1222I-SC-A. These Advantech solutions are fiber optics ports for providing enhanced connectivity in services, including long distance transmission as well as protocol conversion. Therefore, the expansion of industrial IoT for digital twins and augmented reality technology are some of the factors that are analyzed to drive the growth of the Electrical Components Market.

Challenges – Electrical Components Market

Economic Impact by Covid-19 pandemic

The outbreak of Covid-19 pandemic represents as the twin challenges to lives and livelihoods. The implication of the pandemic to business is very disruptive, and most of the industry verticals, such as manufacturing, construction, power and other sector are witnessing economic complexities. Hence, these unexpected pandemic consequences brought severe repercussions to various electrical components, and impede the growth of Electrical Components Market.

Market Landscape

Partnerships and acquisitions along with product launches are the key strategies adopted by the players in the Electrical Components Market. The Electrical Components Market top 10 companies include:

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Panasonic Corporation

- TE Connectivity Ltd.

- Amphenol Corporation

Developments:

- In 2022 ABB India declared to expand and upgrade the small power manufacturing unit in Bengaluru, India. The manufacturing facility would help cater to the growing demand for low-voltage power equipment and components from the industries.

- In 2022 Hitachi Energy invested $37 million to expand its transformer manufacturing unit in Virginia. This development would likely cater to the increase in requirements for transformers from industrial facilities, data centers, and renewable energy generators.

For more Electronics and Instrumentation Market reports, please click here

1. Electrical Components Market- Overview

1.1. Definitions and Scope

2. Electrical Components Market- Executive Summary

3. Electrical Components Market- Comparative Analysis

3.1. Company Benchmarking - Key Companies

3.2. Global Financial Analysis - Key Companies

3.3. Market Share Analysis - Key Companies

3.4. Patent Analysis

3.5. Pricing Analysis

4. Electrical Components Market- Start-up Companies Scenario

4.1. Key Start-up Company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Venture Capital and Funding Scenario

5. Electrical Components Market– Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing Business Index

5.3. Case Studies of Successful Ventures

6. Electrical Components Market- Forces

6.1. Market Drivers

6.2. Market Constraints

6.3. Market Challenges

6.4. Porter's Five Force Model

6.4.1. Bargaining Power of Suppliers

6.4.2. Bargaining Powers of Customers

6.4.3. Threat of New Entrants

6.4.4. Rivalry Among Existing Players

6.4.5. Threat of Substitutes

7. Electrical Components Market– Strategic Analysis

7.1. Value Chain Analysis

7.2. Opportunities Analysis

7.3. Market Life Cycle

8. Electrical Components Market– by Building Automation (Market Size – $Million/$Billion)

8.1. Building Automation

8.1.1 BMS(Protocols)

8.1.2 HVAC Control

8.1.3 Lighting Control (Dimmer, Sensors)

8.1.4 Outdoor Control

8.1.5 Sound & Entertainment Systems

8.2. Datacom Accessories

8.2.1 Active Data

8.2.2 Copper Connectivity

8.2.3 Fiber Connectivity

8.2.4 UPS

8.3. Security

8.3.1 Access Control

8.3.2 Fire Protection

8.3.3 Intrusion Protection

8.3.4 Video Surveillance

8.4. Wiring Accessories.

8.4.1 Lamp Receptable

8.4.2 Plugs

8.4.3 Switches & Sockets

9. Electrical Components Market– by Cables & Wires (Market Size – $Million/$Billion)

9.1 Datacom Cables

9.1.1 Communication & Data Cables

9.1.2 Fiber Optic Cables

9.2 LV Cables

9.2.1 Fire Resistant Cables

9.2.2 Low Smoke & Halogen Free Cable

9.2.3 Low Voltage Cables & Wires

9.3 MV&HV Cables

9.3.1 High Voltage Cable

9.3.2 Medium Voltage Cables

9.4 Special Cables

9.4.1 Mining Oil & Gas Cables

9.4.2 Photovoltaic Cables

9.4.3 Ship & Harbour Cables

9.4.4 Windmill Cables

10. Electrical Components Market– by Energy Distribution (Market Size – $Million/$Billion)

10.1 MV & HV Energy Distribution

10.1.1 Busways/Buswars

10.1.2 LV/MV Transformers

10.1.3 MV/HV/Distribution and Switchgears

10.1.4 MV/HV/Equipment (Overhead Line Material Connections)

10.1.5 Transient Voltage

10.1.6 Surge and Lightining Protection

10.1.7 VCB ( ACB's)

10.1.8 Quality Energy (Capacitors, Harmonics)

11. Electrical Components Market– by Industrial Automation Market Size – $Million/$Billion)

11.1. Automation Controls

11.1.1 Human Machine Interface

11.1.2 Industrial Buses

11.1.3 Input/Output Analy Speciality Cards

11.1.4 Programmable Logic Control

11.1.5 Software

11.1.6 SCADA

11.2. Auxiliary Controls

11.2.1 Light Towers and Beacons Horns

11.2.2 Push Buttons, Turning Knobs, Power Control, CAM Switches

11.3. Drives & Motion Controls

11.3.1 Inverters, Variable Speed Drives

11.3.2 Motors

11.3.3 Starters

11.4. Measurement Controls

11.4.1 Encoders

11.4.2 Industive and Capacitive Sensors

11.4.3 Measure and Control

11.4.4 Mechanical Sensors

11.4.5 Optical Sensors

11.5. Relays

11.5.1 Auxiliary Relays

11.5.2 Contactors

11.5.3 Industrial & Control Interfaces

12. Electrical Components Market – by Lightening (Market Size – $Million/$Billion)

12.1. Fixtures

12.1.1 Emergency Lightening

12.1.2 Indoor Lightening Decorative for Commercial and Hospitality

12.1.3 Indoor Lightening Functional for Commercial, Office and Hospitality

12.1.4 Industrial Lightening for Industry

12.1.5 Outdoor Lighting for Pathway, Garden, Building

12.1.6 Outdoor Lighting for Street

12.1.7 Outdoor Lighting Projectors for Monument

12.2. Lamps & LEDs

12.2.1 Discharge for Stadium & Areas

12.2.2 Fluorescents CFL Tubes for Parking, Office and Residential

12.2.3 Halogen for Commercial & Shops

12.2.4 Incandescent for Residentials

12.2.5 LED"A" Lamps (Replacing Incandescent in Residential)

12.2.6 LED GU 5.3 & GU 10 (Replacing Halogen for Commercial & Shops)

12.2.7 LED Tube (Replacing Fluo tube for Parking and Office)

13. Electrical Components Market – by Power Distribution (Market Size – $Million/$Billion)

13.1. Cable Management

13.1.1 Cable Accessories (Fixing, Connectors, Glands, Shrinks...)

13.1.2 Cable trays & Ladders

13.1.3 Conduits & Pipes, (incl. Prewired Conduits)

13.1.4 Floor & Desk Elements (Column, Underfloor..)

13.1.5 Trunkings and Raceaways (Plastic and Metal)

13.2. Enclosures & Panels

13.2.1 Boxes, Covers, Troughs

13.2.2 Enclosures (Empty)

13.2.3 Equipped Enclosures

13.2.4 Panel Assembly (DIN Rails, Copper Bars, Air Exchangers...) excl. Terminal Blocks

13.2.5 System Enclosures

13.2.6 Terminal Blocks

13.3. LV Electrical Distribution

13.3.1 MCCB's & ACB's

13.3.2 Modular/DIN-Rail-Mountable Protection Devices

13.3.3 Modular/DIN-Rail-Mountable Control Devices

13.3.4 Other Electrical Distribution (Fuses & Fuse Holders)

14. Electrical Components Market – by Renewable Energies (Market Size – $Million/$Billion)

14.1. HVAC

14.1.1 Air Conditioning

14.1.2 Heating

14.1.3 Ventilation

14.1.4 Water Heating)

14.2. Renewable Energies

14.2.1 Heat Pumps

14.2.2 Photovoltaic

14.2.3 Solar Heating

14.2.4 Windmills Residential

15. Electrical Components Market – by Safety & Tools (Market Size – $Million/$Billion)

15.1. Others

15.1.1 Engineering Supplies Batteries

15.1.2 Engineering Supplies Chemical and Paints

15.1.3 Engineering Supplies Fluid ,Air & Transfer

15.1.4 Engineering Supplies Power Transmission

15.1.5 Engineering Supplies Tapes, Adhesives and Resins

15.2. Safety Equipment

15.2.1 Health & Hygiene

15.2.2 Personal Protection

15.2.3 Technical Safety Equipment & Gas Detection

15.2.4 Workplace Safety Signs

15.3 Working Tools & Accessories

15.3.1 Cutting Tools & Abrasives

15.3.2 Fasteners Anchors & Fittings

15.3.3 Fasteners Cable Ties

15.3.4 Fasteners Screws & Bolts

15.3.5 Hand Tools

15.3.6 Measurement Tools

15.3.7 Power Tools

16. Electrical Components Market – by Geography (Market Size – $Million/$Billion)

16.1. Americas

16.1.1 U.S

16.1.2 Canada

16.1.3 Mexico

16.1.4 Brazil

16.1.5 Argentina

16.1.6 Chile

16.1.7 Colombia

16.1.8 Peru

16.1.9 Puerto Rico

16.1.10 Costa Rica

16.1.11 Cuba

16.1.12 Dominican Republic

16.1.13 Ecuador

16.1.14 Guatemala

16.1.15 Panama

16.1.16 Paraguay

16.1.17 Uruguay

16.1.18 Rest of Americas

13.2. Europe

13.2.1. Germany

13.2.2. France

13.2.3. UK

13.2.4. Italy

13.2.5. Spain

13.2.6. Russia

13.2.7. Netherlands

13.2.8. Poland

13.2.9. Switzerland

13.2.10. Turkey

13.2.11. Sweden

13.2.12. Norway

13.2.13. Ireland

13.2.14. Austria

13.2.15. Belgium

13.2.16. Czech Republic

13.2.17. Finland

13.2.18. Denamrk

13.2.19. Romania

13.2.20. Hungary

13.2.21. Portugal

13.2.22. Greece

13.2.23. Belarus

13.2.24. Bulgaria

13.2.25. Croatia

13.2.26. Estonia

13.2.27. Lativa

13.2.28. Lithuania

13.2.29. Luxemburg

13.2.30. Serbia

13.2.31. Slovak Republic

13.2.32. Slovenia

13.2.33. Ukraine

13.2.34. Macedonia

13.2.35. Rest of Europe

13.3. Asia-Pacific

13.3.1. China

13.3.2. Japan

13.3.3. South Korea

13.3.4. India

13.3.5. Australia

13.3.6. New Zealand

13.3.7. Indonesia

13.3.8. Malaysia

13.3.9. Taiwan

13.3.10. Thailand

13.3.11. Pakistan

13.3.12. Bangladesh

13.3.13. Singapore

13.3.14. Philippines

13.3.15. Vietnam

13.3.16. Kazakhstan

13.3.17. Azerbaijan

13.3.18. Hong Kong SAR, China

13.3.19. Macao SAR,China

13.3.20. Myanmar

13.3.21. Sri Lanka

13.3.22. Uzbekistan

13.3.23. Rest of Asia-Pacific

13.4. Rest of The World

13.4.1. Middle East

13.4.2. Africa

14. Electrical Components Market– Entropy

15. Electrical Components Market– Industry/Segment Competition Landscape

15.1. Market Share Analysis

15.1.1. Market Share by Product Type – Key Companies

15.1.2. Market Share by Region – Key Companies

15.1.3. Market Share by Country – Key Companies

15.2. Competition Matrix

15.3. Best Practices for Companies

16. Electrical Components Market– Key Company List by Country Premium

17. Electrical Components Market- Company Analysis

17.1 ABB Ltd.

17.2 Siemens AG

17.3 Schneider Electric SE

17.4 General Electric Company

17.5 Eaton Corporation

17.6 Mitsubishi Electric Corporation

17.7 Hitachi, Ltd.

17.8 Panasonic Corporation

17.9 TE Connectivity Ltd.

17.10 Amphenol Corporation

"Financials to the Private Companies would be provided on best-effort basis."